Anthony Price had a

problem. Like a number of Owsley County, Kentucky residents, Price travels for

work. “Unless you work for the school system or the state, there’s not a lot of

options,” Price says of economic opportunity in what the U.S. Census Bureau’s

2016 American Community Survey found was the third-poorest county in the United

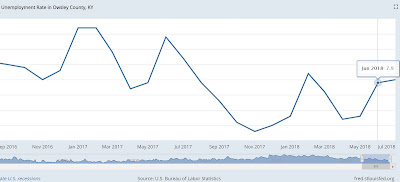

States. Owsley County’s July 2018 unemployment rate of 8.0 percent was nearly

double the state’s rate.

|

| The Census Bureau's Opportunity Atlas paints a challenging portrait of Owsley County, Kentucky. |

Traveling for Norfolk

Southern on a large production railroad tie gang is good for Price’s finances.

It hasn’t made accessing financial services in his hometown of Booneville that

easy, though. This isn’t surprising given the lack of opportunity that has long

plagued remote Appalachian areas – a fact summed up in this snapshot by the Census

Bureau’s “Opportunity Atlas” (also shown at right).

“The banks want you to

come in physically and sign papers and wait a week or two for a loan

application,” Price says.

That route is tough on

people who earn their living away. Last year, Price used an online credit

provider for a vehicle loan. He did it despite having good credit and despite

the 23 percent interest rate.

Then Price learned about

Appalachian Community Federal Credit Union

(ACFCU). The mission-driven CDFI credit union placed a “virtual teller machine”

in Booneville in 2017 specifically to help address its vastly underserved

population by using financial technology.

|

| Lisa Botner is a Booneville native who is working to help develop her home county. |

Price, who was needing a

new work vehicle, messaged former classmate and ACFCU specialist Lisa Botner on Facebook – virtual step one.

ACFCU’s Owsley County

model helps the credit union reach underserved communities where

brick-and-mortar locations might not be justifiable. It frees up resources so people

like Lisa can partner with non-profits, provide financial coaching and help

spur community and economic development.

“One phone call got the

process started, and she had all the paperwork ready for me when I came home,”

Price says. Price also refinanced the high-interest online loan and is saving

hundreds in interest.

Price says he didn’t

know about ACFCU’s mission until Botner filled him in. He’s certainly spreading

the word about this new option for Owsley Countians.

|

| Unemployment remains stubbornly high in Owsley County. |

“I’ve told everybody,”

he says. “It’s a good thing, especially for the people over there when there’s

limited options.”

ACFCU’s commitment

extends to financial coaching, combined with fair lending products, designed to

help members stair step their way to greater financial health and stability,

regardless of income.

“It’s been hard getting

through to people that there’s something different,” Botner says. “At first

people were confusing us with a payday lender. Getting people to understand we

don’t just hand out money and charge you horribly high interest rates has been

a challenge.”

Botner says she

anticipated those challenges. “But word’s getting out, people are figuring out

what we’re really about and we’re actually starting to earn people’s trust.”